“Chasing A Memory: How My Mom’s Death Has Affected My Spending Habits”

Me and my mom

In my last post we discussed how many of my current poor spending habits took root because my childhood experiences made money seem endless; no limits were set. There is another, more recent event in my life that has also influenced my relationship with money: my mom’s death.

My mom’s life and memories were robbed by Alzheimer’s. Not the typical image of an Alzheimer’s victim, she began showing symptoms when she was only 50 years old due to the genetic early-onset type of Alzheimer’s. Fast and emotionally painful, the progression took her life when she was only 62.

When she died, my family mourned in the only way we knew how: shopping. In two sorrow-filled days at the mall, we blew our income tax refund and my husband’s bonus.

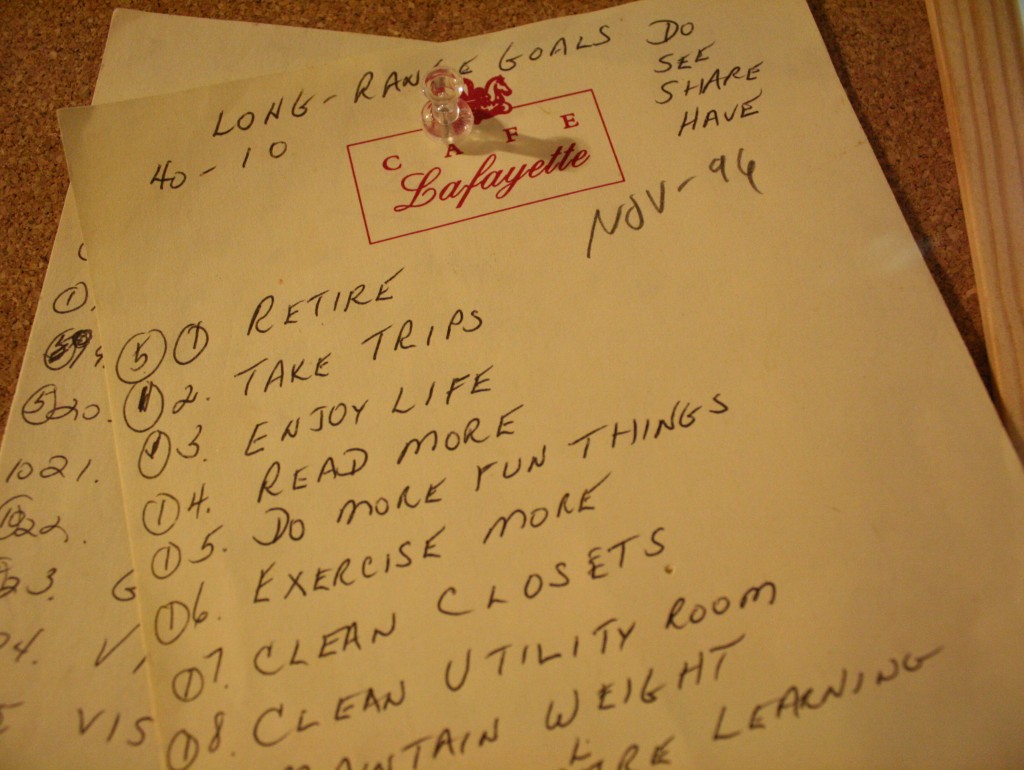

Tacked to the bulletin board in my dad’s house is a list that my mom wrote when she was in the very early stages of the disease. It’s a list of dreams, goals, and aspirations for herself and her family. They were, sadly, never fulfilled in her lifetime.

Now, I’m worried that in 15 years or so, my memory will begin fading. That list reminds me to live each day to its fullest and cherish every moment with my family and my friends. I know that financial freedom will come one day, but it will not come by denying my husband and kids an amazing life with their mom.

Because my mother had her life and memories cut short so young, I feel like I have a short time left to accomplish my life’s dreams. When you have those fears, paying off debt doesn’t really become a priority. It could be 10 years before I’m out of debt, and I’m not sure I can wait that long to start experiencing life. It’s almost like I feel I have to create memories with my kids now so that they can remember for me if or when I start to forget.

At the same time, I also know I can’t jeopardize the financial security of my family for a good time. To keep my kids from paying for MY financial mistakes, I have to try and find a balance between creating an exciting, adventurous life for my family while being financially responsible.

COMMENT: What would you do? Save for the future or enjoy life now? Is it possible to do both?

FOLLOW: Like what you see? Add our RSS feed! [what’s that?]. Or start your morning with Republic of Austin in your InBox! Or read us 24-7 on Twitter!

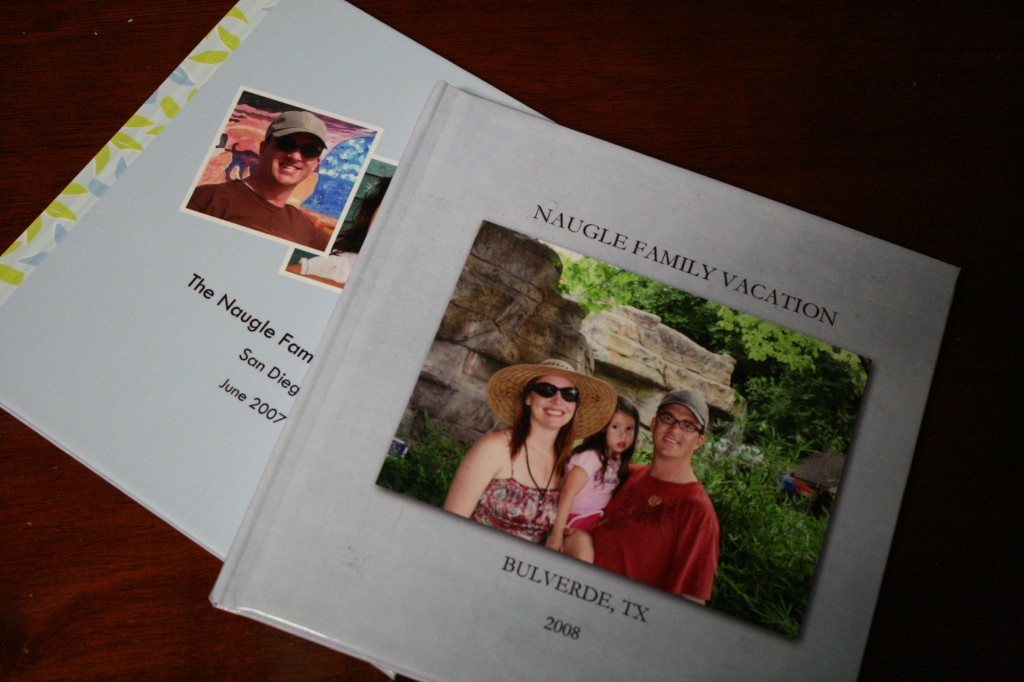

Family vacations take on a new meaning now

No related posts.

Related posts brought to you by Yet Another Related Posts Plugin.

You are so awesome for posting this Rachel as I know it came from your heart. Your question is a good one and if someone knows the “secret” for being able to do both, I’d love to learn! I am sitting in a similar boat and want to live life to it’s fullest, while still taking care of business.

I bet your mom would be proud of you!

Thanks, April! I’m glad you got something out of the post. I’m hoping to explore some ways for us to do both, so keep reading as I’ll share what I learn.

This message was very sad, inspirational, and eye opening. Great article Rae! I need to read these more often.

Yes, Joseph, you do need to read them more often! If you looked at my mom’s list most of the top ones didn’t really involve money - “enjoy life” was #2, and “do more fun things” was #5. I’m definitely going to start with those. I’ll probably skip the cleaning ones!

Great post, Rachel. You inspire me in ways that you probably have no idea- I really appreciate your ability to be so honest and forthcoming in your blog posts.

That means a lot, Liz! I’m really trying to explore the emotional aspect of money since I think that’s largely ignored by most financial experts. They are like, “Follow this simple plan and you’ll be a millionaire”, but for me, as I’m sure for most people, it’s not that easy.

Great article, Rachel. I agree that “enjoying life” doesn’t necessarily mean having to spend money. I grew up with parents who had the opposite view on spending. Even though they had money, they didn’t spend it. They were very frugal and believed in not “spoiling” children — almost to the extreme. However good or bad that is, my brother and I do have some awesome memories of things that didn’t require much money. Camping, trips to grandparent’s houses, picnics, hikes, homemade ice cream making at home are just a few of the memories that stand out. We road-tripped to most of our vacations — some of the best memories were the road trip and not the destination. Anyway, I’m rambling on but you get the point!

I totally agree, Karen, that some of the best memories are free. I heard somewhere that we often, as adults, end up doing either the same or the opposite of what our parents did. I guess in an ideal world I would do what my parents did, but I also realize that that environment set me up for my bad habits…and my brother’s Finding the right balance is key.

Finding the right balance is key.

I think you can do both. You definitely inspired me to create my own bucket list and make sure that I start checking things off before I hit middle age. As always, loved this.

Thanks, Ari! I’m actually thinking of trying to complete my mom’s list for her. Thankfully a lot of them have actually been done, bur I thought it would be a good experience and a way to honor her.